Using Valuation Premiums to Buy Reality: How Fiction Becomes Currency

- Sunil Dutt Jha

- Apr 8

- 5 min read

In today's financial ecosystem, companies with modest revenues are trading at valuations that defy business logic. A firm with $500 million in revenue can command a $50 billion valuation, and nobody flinches.

But this isn’t just hype. It’s not just optimism. It’s not even irrational exuberance anymore.

It’s a system. A game. A currency.

When a company’s valuation-to-revenue ratio is 30x, 50x, or 100x, it's not just overvalued—it's weaponized.

Welcome to the real game behind the markets:Using inflated valuation premiums to buy the real economy.

Step 1: Inflate the Narrative

It starts with a story:

“We’re building AGI.”

“We’re redefining healthcare.”

“We’re building the cloud infrastructure of the future.”

Wall Street loves it. VC firms amplify it. Index funds pile in. Valuation skyrockets—not based on earnings, but on expectation.

A company generating $2 billion in revenue suddenly finds itself worth $200 billion.

That $198 billion delta? That’s not value. That’s leverage.

Step 2: Monetize the Gap

Now the company moves. With a $198 billion “premium” above reality, it can issue new shares or take on debt secured against that inflated market cap.

It doesn’t need profit. It doesn’t need cash flow. It now has fiction-backed firepower.

They use this to:

Fuel acquisitions.

Build data centers.

Launch expansions into markets they know nothing about.

They’re not spending profits. They’re spending narrative.

The Missing Anatomy Behind the Story

These companies don’t just operate with inflated valuations—they operate without an integrated anatomy.

They scale narratives, not systems.

They acquire infrastructure, teams, markets—but never align them into a coherent whole. No strategic model connecting what they promise, what they build, and how they operate.

This is where most collapses begin—not in the press release, but in the missing blueprint behind it.

If you X-ray these companies, you won’t find a working anatomy.

No consistent linkage between:

What strategy they declare

What processes they run

What systems they rely on

What components they build

What implementation tools they use

What operations they track

Instead, they run on fragments and press cycles—not enterprise logic.

And in the absence of anatomy, narrative becomes the only glue holding the enterprise together. Until it breaks.

Step 3: Acquire Reality

With their overvalued stock acting as currency, they start buying real assets:

Startups — to kill competition or rebrand as internal innovation.

Land, factories, infrastructure — to claim “we’re building at scale.”

Supply chains — to control verticals they never built.

Media relationships and lobbying power — to shape perception and policy.

They even influence regulation through economic mass—“Too big to question.”

And all of it was purchased with speculative capital the market gifted them.

Step 4: Outsource the Risk

Here’s the beauty of this system—for them:

The acquired companies do the hard work (manufacturing, operations, logistics).

The parent company keeps the story going.

If something fails?

Write it off.

Blame integration complexity.

Let the market forgive and forget—because the next press release is already being drafted.

No accountability. No margin risk. Because valuation is built on belief, not business.

Real Examples That No One Talks About

Let’s connect the dots:

Amazon bought Whole Foods not for profit—but to control food retail visibility and build private-label dominance using cloud-scale infrastructure.

Meta used inflated equity to buy VR companies, then quietly killed them off while telling investors “we’re building the metaverse.”

Tesla's market cap surge gave it enough leverage to fund gigafactories on subsidized land, claiming scale while outsourcing risk to local governments.

Alphabet constantly acquires startups—then repackages them as “moonshots,” using the brand power of Google to maintain its story premium.

None of this is fueled by earnings. It’s funded by narrative premium. By fiction capital.

The Strategic Risk: Story as Sovereignty

This isn’t just market distortion.This is economic misdirection on a national scale.

Because while U.S. companies inflate themselves to buy reality—foreign capital is watching.

Chinese VIE structures invest early in U.S. “tech stories.”

European hedge funds ride the narrative until exit.

Sovereign wealth funds park money in inflated companies, extract gains, and reinvest them back home.

In effect, we’ve built a system where:

Narrative becomes collateral.

Fiction becomes currency.

And foreign entities buy U.S. productivity using our own hype machine.

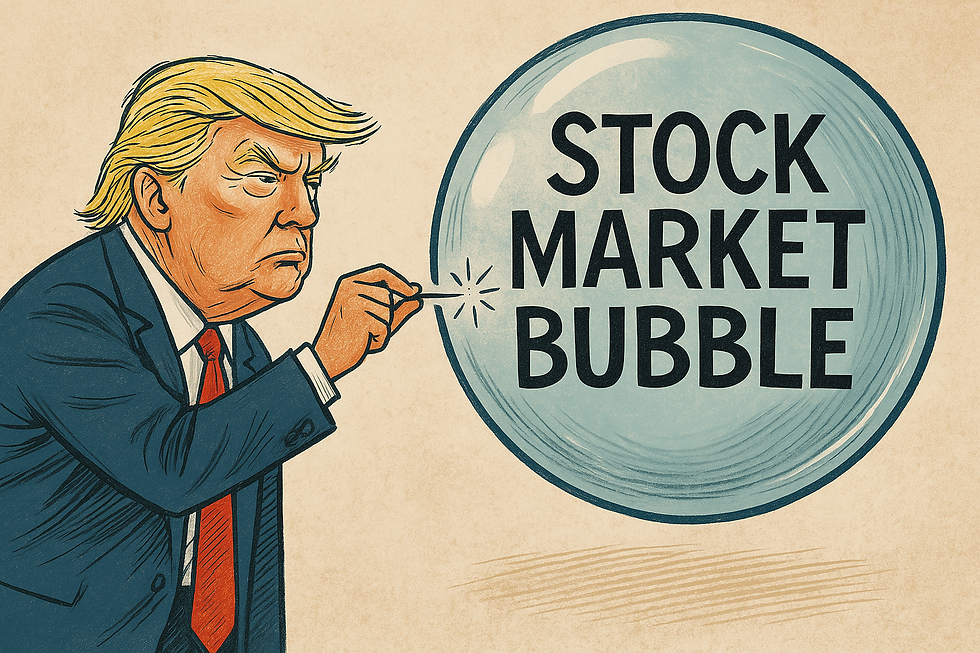

Trump's Business Scars—and Why He Sees the Bubble for What It Is

Donald Trump isn’t just reacting to trade numbers. He’s acting from first-hand trauma that most modern CEOs and politicians will never understand.

In the early 1990s, Trump was buried in over $1 billion of personal debt. He once said:

“I was poorer than a beggar on the street. He had zero. I had minus one billion.”

But unlike many tech CEOs who play with investor money, Trump was personally liable. He felt the heat of missed loan calls. He negotiated with real banks, not PR firms. He cut costs, faced headlines, and still got back up.

That kind of experience creates permanent clarity:

Cash flow matters.

Profit is not optional.

Narrative means nothing if the numbers don’t work.

So when Trump sees multi-trillion dollar tech companies burning cash while being praised as “the future,” he doesn’t just see overvaluation—he sees a threat to economic sanity.

And when he pushes tariffs or rattles markets, he’s not scared of valuation loss.

In fact, he wants certain companies to lose more—because they’ve been falsely propped up by narrative capital, not economic contribution.

His message is clear:

“You want to be worth $2 trillion? Then start earning like it. Or start shrinking.”

Trump’s War Isn’t Just About Trade. It’s About Truth.

Donald Trump isn’t fighting against technology. He’s fighting against financial architecture designed to extract real assets using inflated stories.

He understands this system because he played it—and nearly lost to it.

He’s the first major political figure to say:

“This market isn’t pricing businesses. It’s pricing dreams. And someone else is collecting on our hallucinations.”

Tariffs aren’t just economic levers. They’re tools to burst narrative bubbles—to force companies to stand on business models, not momentum.

Because when valuation is weaponized, the only defense is truth.

And in Trump’s world, truth isn’t what you say. It’s what you build.

Trump’s War Is Against Narrative Capital

This isn’t about tech vs. legacy.

This isn’t about trade vs. globalization.

It’s about economic realism vs. speculative fantasy.

Trump knows the cost of debt. The pain of overextension. The difference between paper wealth and survival.

So when he pops the bubble—whether through tariffs, financial resets, or narrative disruption—he’s not trying to crash markets. He’s trying to reset the scoreboard.

Because in today’s financial system, stories buy assets. And America is losing sovereignty to capital games run on fictional valuations.

Trump’s war isn’t against innovation. It’s against hype that steals from the real economy.

And he’s not bursting bubbles out of spite—he’s bursting them to save the ground they’re floating above.

That’s the real war ahead—not just against bubbles, but against corporations floating without anatomy.

Because without anatomy, valuation becomes speculation.

And without Enterprise Anatomy, story is the only skeleton they stand on.

It’s not just fragile—it’s dangerous.

Trump sees the bubble.

Enterprise leaders must start seeing the anatomy.

Comments